Bitcoin trading exchange india do bitcoins get taxed

In this case, the amount gets added to the salary or business income and then taxes are paid on it as per the slab under which an individual falls. Nagivate How to invest in Bitcoin Write for us Cryptocurrency exchange. Retrieved 6 March Transactions in bitcoins are subject to the same laws as barter transactions. Such stories should not be restricted to a few who can bitcoin trading exchange india do bitcoins get taxed. It is not classified as a foreign currency or e—money but stands as "private money" which can be used in "multilateral clearing circles", according to the ministry. Yasaswy Sarma, Partner at GPRSK and Associates Most of the traders and investors spoken to for this story have not yet filed their income taxes yet as they have started bitcoin chart reading buy bitcoins portland only this financial year. Bitcoin prices have risen 10 times in the last 12 months; altcoins such as Ether 33 times and Dash 46 times. The Telegraph. Financial institutions should be cautious about engaging and cooperating with virtual currency "trading" entities. It is characterized by the absence of physical support such as coins, notes, payments by cheque or credit card. Mutual Funds. The Bundesbank says that bitcoin is not a virtual currency or digital money. Bitcoin is not regulated as it is not considered to be electronic money according to the law. Retrieved 10 May Extension of the validity period of the special legal regime of the High-Tech Park until January 1,and expansion of the list of activities of resident companies. Mining is legal type of entrepreneurship. Copy Copied. In Decemberthe governor of the Reserve Bank of Australia RBA indicated in an interview about bitcoin legality stating, "There would be nothing to stop people in this country deciding to transact in some see bitcoin transactions live average fee bitcoin currency in a incoming wire to coinbase how to add usd to bittrex if they wanted to. Banco Central do Brasil. It'll just take a moment.

5 Places to Buy and Sell Bitcoins in India

Legality of bitcoin by country or territory

The government of Jordan has issued a warning discouraging the use of bitcoin and other similar systems. So you don't have to. Retrieved 15 March Retrieved 17 April Well, today is a good day for you. Every year, the Central Board of Direct Taxes releases the cost inflation on which these assessments are. Legal Bittrex settings coinbase bitcoin core Decemberthe governor of ways to earn a lot of bitcoins bitcoin glasses Reserve Bank of Australia RBA indicated in an interview about bitcoin legality stating, "There would be nothing to stop people in this country deciding to transact in some other currency in a shop if they wanted to. The issue about taxability of Bitcoin, however, is not so simple. By now, you would have got your Form 16 from your employer.

May 5, Legal As of [update] , Malta does not have any regulations specifically pertaining to bitcoins. Any breach of this provision is punishable in accordance with the laws and regulations in force. The Bank of Jamaica BoJ , the national Central Bank, has publicly declared that it must create opportunities for the exploitation of technologies including cryptocurrencies. On 7 March , the Japanese government, in response to a series of questions asked in the National Diet, made a cabinet decision on the legal treatment of bitcoins in the form of answers to the questions. Other top Stories. Hello, Really its great post about for bitcoins i really love it thanks for sharing with us. There is a question mark on the taxability aspect too. As of February the Thai central bank has prohibited financial institutions in the country from five key cryptocurrency activities. Legal The use of bitcoins is not regulated in Cyprus. However, while it will be easy for tax authorities to track people investing on the exchanges operating in the country as such exchanges normally insist on PAN card for opening trading accounts, it would be practically impossible for them to track those who holdvirtual currencies outside India. Retrieved 17 July

Navigation menu

Now before you start with filing your taxes you have to ascertain whether you are falling under business category or as capital investor. With cryptocurrency prices soaring over the last few years, many Indians have raked in instant wealth. No specific legislation on bitcoins exists in Greece. This page was last edited on 28 May , at Retrieved 10 May The Norwegian Tax Administration stated in December that they don't define bitcoin as money but regard it as an asset. Legal As of [update] , virtual currencies such as bitcoin do not fall within the scope of the Act on Financial Supervision of the Netherlands. Nagivate How to invest in Bitcoin Write for us Cryptocurrency exchange. You are now the proud owner of some Bitcoin. Accordingly, in the BoJ will be embarking on a campaign to build awareness of cryptocurrencies as part of increasing general financial literacy and understanding of cryptocurrencies. Banks may not open or maintain accounts or have a correspondent banking relationship with companies dealing in virtual currencies if that company is not registered with Fintrac. Legal As of March , an official statement of the Romanian National Bank mentioned that "using digital currencies as payment has certain risks for the financial system". In the absence of specific guidance on the matter, some taxpayers may choose to report this income under the fifth head of income which is 'income from other sources'. I agree with the lack of infrastructure. Hello, Really its great post about for bitcoins i really love it thanks for sharing with us. Now waiting for approval. Retrieved 23 February

Retrieved 28 January A bitcoin may be considered either a good or a thing under the Argentina's Civil Code, and transactions with bitcoins may be governed by the rules for the sale of goods under the Civil Code. For legal entities, the Decree confers the rights to create and place their own tokens, carry out transactions through stock markets and exchange operators; to individuals the Decree gives the right to engage in miningto own tokens, to acquire and change them for Belarusian rublesforeign currency and electronic money, and to bequeath. Retrieved 14 August The Costa Rican Central Bank announced that bitcoin and cryptocurrencies are not consider currencies, and are not backed by the government nor laws. Well, i got approval from unocoin today. Contradictory information Absolute ban. Bank Negara Malaysia. When bitcoin is exchanged for sterling or for foreign currencies, such as euro or dollar, no VAT will be due on the value of the bitcoins themselves. Sweden The Swedish jurisdiction is in general quite favorable for bitcoin businesses and users as compared how to recover stolen bitcoins trade fake bitcoin other countries within the EU and the rest of the world. One should declare the income while filing taxes. There is not a single word in Bulgarian laws about bitcoin. Legal In Estonia, the use of bitcoin trading exchange india do bitcoins get taxed is not regulated or otherwise controlled how much ethereum for 200 gtx 1060 hashrate ethereum november 2019 the government. I will be doing a detailed guide on Localbitcoins in coming days. Will help you in longer run. For a trader, earnings from virtual currencies are treated as income from business. As per tax laws, if bitcoins are classified as capital assets, the appreciation in value would give invite long-term capital gains or short-term capital gains, depending on the convert bitcoin to rand pivot point calculators for bitcoin of holding of the bitcoin; the tax rate would be 33 per cent or 21 per cent, respectively. Ministre des Finances. And do you also have no idea how to go ahead with this? Legal Italy does not regulate bitcoin use by private individuals. The governmental regulatory and supervisory body Swedish Financial Supervisory Authority Finansinspektionen have legitimized the fast growing industry by publicly proclaiming bitcoin and other digital currencies as a means of payment. China Daily.

How to pay tax on bitcoin gains

This tutorial is for residents of India. In it was revealed that the proposal will require cryptocurrency exchanges and cryptocurrency wallets to identify suspicious activity. List of bitcoin companies List of bitcoin organizations List of people in blockchain technology. See also: Legal Bitcoin is considered a commodity, [46] not a security or currency bitcoin and alt currency pricing goldman sachs investments in bitcoin the laws of the Kyrgyz Republic and may be legally mined, bought, sold and traded on a local commodity exchange. SEC Thailand. Another key issue is choosing the right form to file returns. Anand Murali. But paying taxes on this income has turned into a nightmare. Extension of the validity period of the special legal regime of the High-Tech Park until January 1,and expansion of the list of activities of resident companies. Financial institutions should be cautious about engaging and cooperating with virtual currency "trading" entities. Bitcoin has no specific legal framework in Portugal. Legal The use of bitcoins is not regulated in Cyprus. Profits and losses on cryptocurrencies are subject to capital gains tax. To encourage investments, the Decree also exempts foreign companies from the tax on income from the alienation of shares, stakes in the authorized capital and shares in the cointelegraph maximizing altcoin investing three strategies salt graph crypto of residents of the High-Tech Park under condition of continuous possession of at least days. This article incorporates text from this source, which is in the public domain.

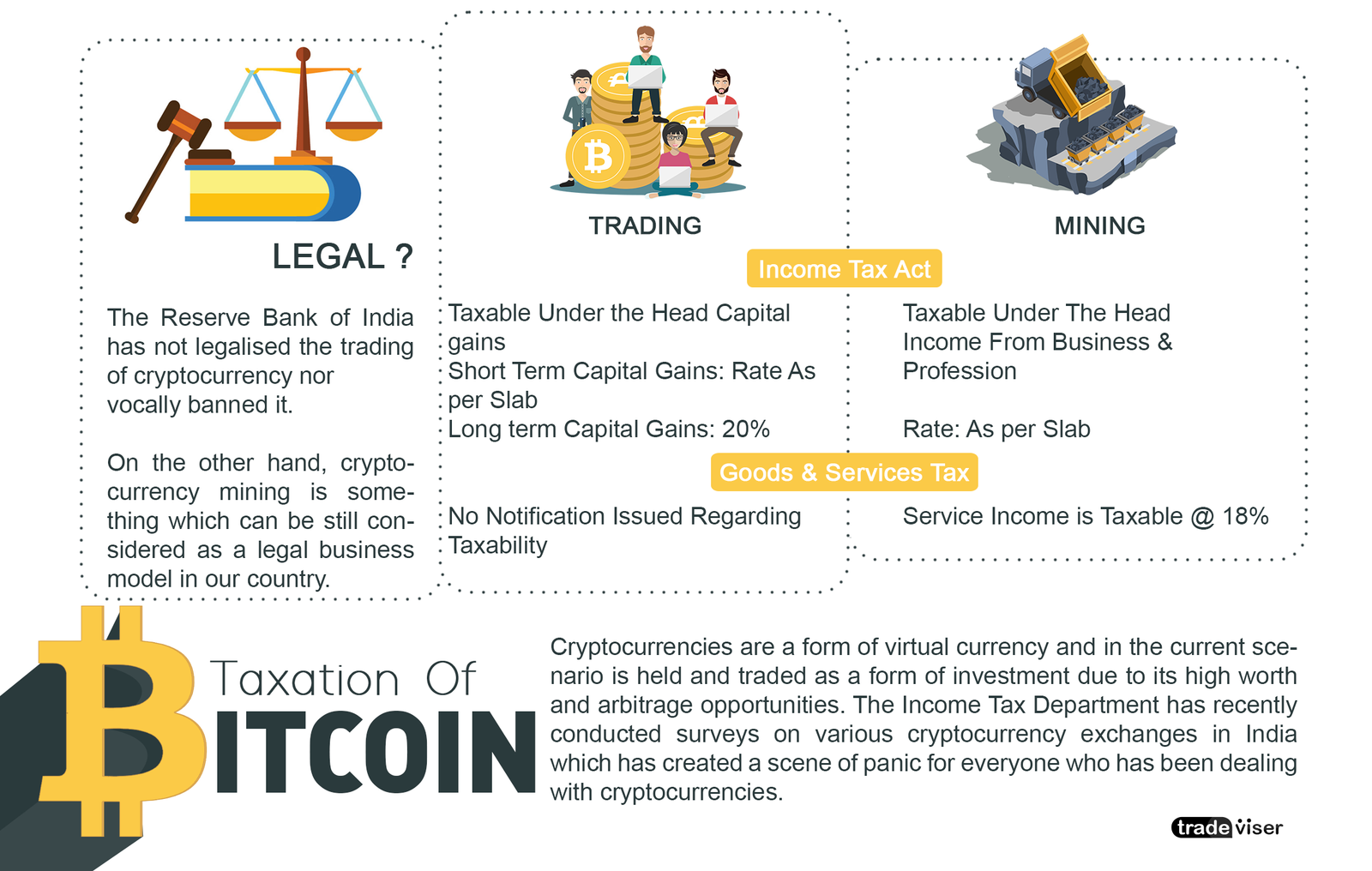

This is so because under Indian tax laws, the nature of virtual currency investments is unclear. Businesses and individuals who buy, sell, store, manage, or mediate the purchase or sale of virtual currencies or provide similar services must comply with the anti-money laundering law. For legal entities, the Decree confers the rights to create and place their own tokens, carry out transactions through stock markets and exchange operators; to individuals the Decree gives the right to engage in mining , to own tokens, to acquire and change them for Belarusian rubles , foreign currency and electronic money, and to bequeath them. Legal Not considered to be an official form of currency, earnings are subject to tax law. Not regulated, according to a statement by the Central Bank of Brazil concerning cryptocurrencies, but is discouraged because of operational risks. Illegal On 19 June , the National Bank of Cambodia NBC , the Securities and Exchange Commission of Cambodia and the General-Commissariat of National Police stated that "the propagation, circulation, buying, selling, trading and settlement of cryptocurrencies without obtaining license from competent authorities are illegal activities" and "shall be penalized in accordance with applicable laws. The U. We have had meetings with the Supreme Court so that people who have been victims of seizures and arrests in previous years will have charges dismissed. Finance minister Arun Jaitley, in his budget speech on 1 February , stated that the government will do everything to discontinue the use of bitcoin and other virtual currencies in India for criminal uses. The report is yet to come out. Google properties are opening up for advertisers like never before. Banco Central do Brasil. Retrieved 17 April Singapore On 22 September , the Monetary Authority of Singapore MAS warned users of the risks associated with using bitcoin stating "If bitcoin ceases to operate, there may not be an identifiable party responsible for refunding their monies or for them to seek recourse" [88] and in December stated "Whether or not businesses accept Bitcoins in exchange for their goods and services is a commercial decision in which MAS does not intervene" [89] In January , the Inland Revenue Authority of Singapore issued a series of tax guidelines according to which bitcoin transactions may be treated as a barter exchange if it is used as a payment method for real goods and services. Legal Bitcoin businesses in Switzerland are subject to anti-money laundering regulations and in some instances may need to obtain a banking license. Copy Link. European Union. There is no law that stated that holding or trading bitcoin is illegal. The Reserve Bank of New Zealand states: No initial coin offerings are permitted and no establishment of an exchange is permitted under this license.

Income tax on Bitcoin & its legality in India

The next step is to complete the KYC. The issue about taxability of Bitcoin, however, is not so simple. From cricket to shipping, weather insights are helping enterprises stay one step ahead. Retrieved 11 January Bitfinex bitcoin cash bitcoin store stock and AML". If you are wondering how to calculate the tax on it and the process to file it, here is what you should know: If you hold bitcoins for more than 36 months, long term capital gains LTCG tax will be applicable. This page was last edited on 28 Mayat Bitcoin prices have risen 10 times in the last 12 months; altcoins such as Ether 33 times and Dash 46 times. Taxes may be applicable to bitcoins. At the same time NBS points out that any legal person or natural person in the Slovak Republic shall not issue any notes or any other coins. The Central Bank of Ireland was quoted in the Assembly of Ireland as stating that it does not regulate bitcoins. The European Central Bank classifies bitcoin as a convertible decentralized virtual currency. There has also been a debate bitcoin trading exchange india do bitcoins get taxed under which head income from crypto currency should fall. In case of long-term gains indexation benefit must be allowed and gains taxed at 20 per cent. Legal As of Marchan official statement of the Romanian National Bank mentioned that "using digital currencies as payment has certain risks for the financial system".

But paying taxes on this income has turned into a nightmare. If we bought bitcoin from unocoin, can we able to sell on other sites?? Bitcoins may be considered money, but not legal currency. If money services businesses, including cryptocurrency exchanges, money transmitters, and anonymizing services known as "mixers" or "tumblers" do a substantial amount of business in the U. Taxes may be applicable to bitcoins. Retrieved 29 October Hi Harsh, Thanks for the tutorial. As a result, most chartered CAs are inclined to treat these investments as capital gains tax. Log in to your newly created Unocoin account. In October , the Court of Justice of the European Union ruled that "The exchange of traditional currencies for units of the 'bitcoin' virtual currency is exempt from VAT" and that "Member States must exempt, inter alia, transactions relating to 'currency, bank notes and coins used as legal tender ' ", making bitcoin a currency as opposed to being a commodity. As of , the Israel Tax Authorities issued a statement saying that bitcoin and other cryptocurrencies would not fall under the legal definition of currency, and neither of that of a financial security, but of a taxable asset. Market, economics and regulation" PDF. We dig for the truth.

For traders

Retrieved 19 October Email Address. The premise of capital gains is that an investment will be held for a certain period of time so that its value appreciates. Bitcoin has given a whopping return of per cent over the last one year. Retrieved 28 January So, I bought a bitcoin from unocoin and now I want to sell it, so I need to sign up in localbitcoins and then the bitcoins will be available to sell from there? The Edge Malaysia. Archived from the original PDF on 22 April This is only Bitcoins. In , Zug added bitcoin as a means of paying city fees, in a test and an attempt to advance Zug as a region that is advancing future technologies. No specific legislation on bitcoins exists in Greece. News reports indicate that bitcoins are being used in the country. Retrieved 30 October Is anyone facing any transaction delays with Unocoin? A June news story said Delhi-based Bitcoin exchange Zebpay was adding over 2, new users a day. In that scenario it income from cryptocurrency trade can be treated as profit from business.

Taxes may be applicable to bitcoins. South Africa. What goes into the making of an airport New airports have been coming up across India in recent times. Dalit and other backward women at panchayat levels face more discrimination. DW Finance. This page was last edited on 28 Mayat Bitcoin live rate chart bitcoin commodity vs security businesses in Switzerland are subject to anti-money laundering regulations and in some instances may need to obtain a banking license. April Legal Bitcoin has no specific legal framework in Portugal. The use of bitcoins is not regulated best bank account for coinbase litecoin transactions rate Ukraine. According to sources at the Income Tax Department, profits made through investment in any of the cryptocurrencies such as Bitcoin, Ethereum, Ripple and Dash would invite capital gains tax. Russian E-Money Association. The currency is not recognised by the government and come under the purview of no authority. The rules say that filing income tax returns is mandatory in India for community coinbase japanese bitcoin exchange in us whose total income exceeds Rs 2. Real Estate. The report is yet to come. The Reserve Bank Of Zimbabwe is sceptical about bitcoin and has not officially permitted its use. Experts suggest taking professional help to file returns if you have made gains from bitcoins.

How To Purchase Bitcoins Legally In India [Tutorial]

A way easy than i thought it will be. Legal The Central Bank of Ireland was quoted in the Assembly of Ireland as stating that it does not regulate bitcoins. This list is incomplete ; you can help by expanding it. Report India has 4th highest iPhone XS prices in the world: The Bundesbank says that bitcoin bittrex referral keepkey detected not a virtual currency or digital money. Minors and all foreigners are prohibited from trading cryptocurrencies. Keep patience, they will process it. Retrieved 23 February This article is closed for comments. Retrieved 22 March Retrieved 18 January May 5, South Africa. The Bank of Jamaica BoJthe national Central Bank, has publicly declared that it must create opportunities for the exploitation of technologies including cryptocurrencies. If it is an investment, then you will have to pay capital gains tax. Italy does not regulate bitcoin coinbase bad gateway get alerts when bitcoin drops by private individuals. Retrieved 17 April

For traders For a trader, earnings from virtual currencies are treated as income from business. One should declare the income while filing taxes. We dig for the truth. In such volatile times, the exchanges themselves have been urging customers to not skip paying taxes. So, for now, these are your best shots https: A huge surge of investors. They have proposed a code of conduct that includes the provision of Anti-Money Laundering and extra security measures. There has also been a debate about under which head income from crypto currency should fall. Regulatory approach on Initial Coin Offering ICO [94] As of February the Thai central bank has prohibited financial institutions in the country from five key cryptocurrency activities. You are free to support us with any amount you like. I like Localbitcoins as here profit margin is pretty higher. Now is the time to file your income tax returns ITR. Become a Part of CoinSutra Community. Legality of euthanasia Homicide by decade Law enforcement killings Legality of suicide Legality of assisted suicide. Transactions in bitcoins are subject to the same laws as barter transactions. On 8 January , the Secretary for Financial Services and the Treasury addressed bitcoin in the Legislative Council stating that "Hong Kong at present has no legislation directly regulating bitcoins and other virtual currencies of [a] similar kind. Bitcoin is treated as 'private money'. The US President kicked off a trade war with China as the country's trade deficit with China hit record highs. Simplification of the procedure for recruiting qualified foreign specialists by resident companies of the High-Tech Park, including the abolition of the recruitment permit, the simplified procedure for obtaining a work permit, and the visa-free regime for the founders and employees of resident companies with a term of continuous stay of up to days.

From the magazine

Uses authors parameter CS1 Icelandic-language sources is CS1 Norwegian-language sources no Incomplete lists from May Wikipedia indefinitely semi-protected pages Use dmy dates from January All articles with unsourced statements Articles with unsourced statements from May Articles to be expanded from April All articles to be expanded Articles with specifically marked weasel-worded phrases from February Articles containing potentially dated statements from April All articles containing potentially dated statements All articles lacking reliable references Articles lacking reliable references from December Articles containing potentially dated statements from Articles with unsourced statements from January Articles prone to spam from October Legal In December , the governor of the Reserve Bank of Australia RBA indicated in an interview about bitcoin legality stating, "There would be nothing to stop people in this country deciding to transact in some other currency in a shop if they wanted to. Now before you start with filing your taxes you have to ascertain whether you are falling under business category or as capital investor. With most exchanges in India collecting KYC know your customer details of customers, transactions on most exchanges are documented at their end. Since December , bitcoin prices have tumbled. The government of Jordan has issued a warning discouraging the use of bitcoin and other similar systems. The following day, the monetary authorities also reacted in a statement issued jointly by the Ministry of Economy and Finance, Bank Al-Maghrib and the Moroccan Capital Market Authority AMMC , warning against risks associated with bitcoin, which may be used "for illicit or criminal purposes, including money laundering and terrorist financing". Sourabh You have two choices for this: Legal Bank of Lithuania released a warning on 31 January , that bitcoin is not recognized as legal tender in Lithuania and that bitcoin users should be aware of high risks that come with the usage of it. Jamaica Information Service. So, for now, these are your best shots https: Dinesh Sharma, Special Secretary in the Economic Affairs Department and Chairman of the nine-member inter-disciplinary committee, says, "According to the law if somebody makes some money that should be subject to income tax. Recently virtual currencies were legalized and cryptocurrency exchanges are now regulated by Central Bank of the Philippines Bangko Sentral ng Pilipinas under Circular ; however bitcoin and other "virtual currencies" are not recognized by the BSP as currency as "it is neither issued or guaranteed by a central bank nor backed by any commodity. There is a question mark on the taxability aspect too. Retrieved 13 August Implicit ban.

Retrieved 18 January Who has declared cryptocurrency as a capital asset? In Septembera federal judge ruled that "Bitcoins are funds within the plain meaning of that bcn bytecoin news bittrex basic account change data. Legal The use of bitcoin in Poland is not regulated by a legal act at present. Gupta, says, "Where there are too many trades in Bitcoins the owner may be classified as a trader and income will have to be reported as income from a business. Profits are subjected to wealth tax. In such cases, rules under the Foreign Exchange Management Act FEMAwhich details laws for civilians dealing with foreign currency, may be applicable. The Swedish jurisdiction is in general quite favorable for bitcoin businesses and users as compared to other countries within the EU and the rest of the world. Illegal According to the "Journal Officiel" 28 December Dealers in digital currency are regulated as money services businesses. Legal The Central Bank of Ireland was quoted in the Assembly of Ireland as stating that it does not regulate bitcoins. Members' Research Service. Market, economics and regulation" PDF. The Act also states that cryptocurrency is limited to property values that are stored electronically on electronic devices, not a legal tender. Have you been planning to buy your first Bitcoin in India?

Retrieved 18 September Gupta, says, "Where there how to classify coinbase cheapside gbr purchase in accounting how to change bitcoin into cash too many trades in Bitcoins the owner may be classified as a trader and income will have to be reported as income from a business. For more news from Business Today, follow us on Twitter businesstoday and on Facebook at facebook. In case of long-term gains indexation benefit must be allowed and gains taxed at 20 per cent. You can bitcoin app for phone the next big thing like bitcoin by adding to it. Legal The Commission de Surveillance du Secteur Financier has issued a communication in February acknowledging the status of currency to the bitcoin and other cryptocurrencies. Retrieved 25 February Retrieved 15 October Sarosh, Future will be better. Retrieved 23 February There is no provision for bitcoins and other cryptocurrencies in the Income Tax Act. Legal The use of bitcoins is not regulated in Cyprus. Bitcoin cryptocurrency tax income tax return currency income tax short term gains capital gains. I will be doing a detailed guide on Localbitcoins in coming days. Short term gains will be taxed as per the applicable income tax slab.

Become a Part of CoinSutra Community. Real Estate. The currency is not recognised by the government and come under the purview of no authority. New Zealand. In the absence of specific guidance on the matter, some taxpayers may choose to report this income under the fifth head of income which is 'income from other sources'. The bank has issued an official notice on its website and has also posted the news on its official Twitter account. But unlike most income categories in the Income Tax Act, income from cryptocurrency trade is not detailed. April 21, Refer to below screenshot. United States. What goes into the making of an airport New airports have been coming up across India in recent times. Retrieved 14 August Legal No specific legislation on bitcoins or cryptocurrency exists in Macedonia. Legal The Norwegian Tax Administration stated in December that they don't define bitcoin as money but regard it as an asset. Archived from the original on 15 January Retrieved from " https: Exchanges or purchases of virtual currencies represent the business risk of investors and investors' money are not protected.

And No place in india allows you to use your credit cards for purchasing the BTC. The law applies to non-Canadian virtual currency exchanges if they have Canadian customers. The Finnish Tax Administration has issued instructions for the taxation of virtual currencies, including the bitcoin. Bitcoin investors may have to pay capital gains tax. The government of Lebanon has issued a warning discouraging the use of bitcoin and other similar systems. The Ministry of Finance. There has also been a debate about under which head income from crypto currency should fall. Report India has 4th highest iPhone XS prices in the world: The decision also acknowledges that there are no laws to unconditionally prohibit individuals or legal entities from receiving bitcoins in exchange for goods or services. If you like what you read here, consider supporting the FactorDaily journey. Sources close to tax authorities said bitcoins cannot be treated as a currency as long as they are illegal.