What is 1 bitcoin worth bitmex bitcoin cash distribution

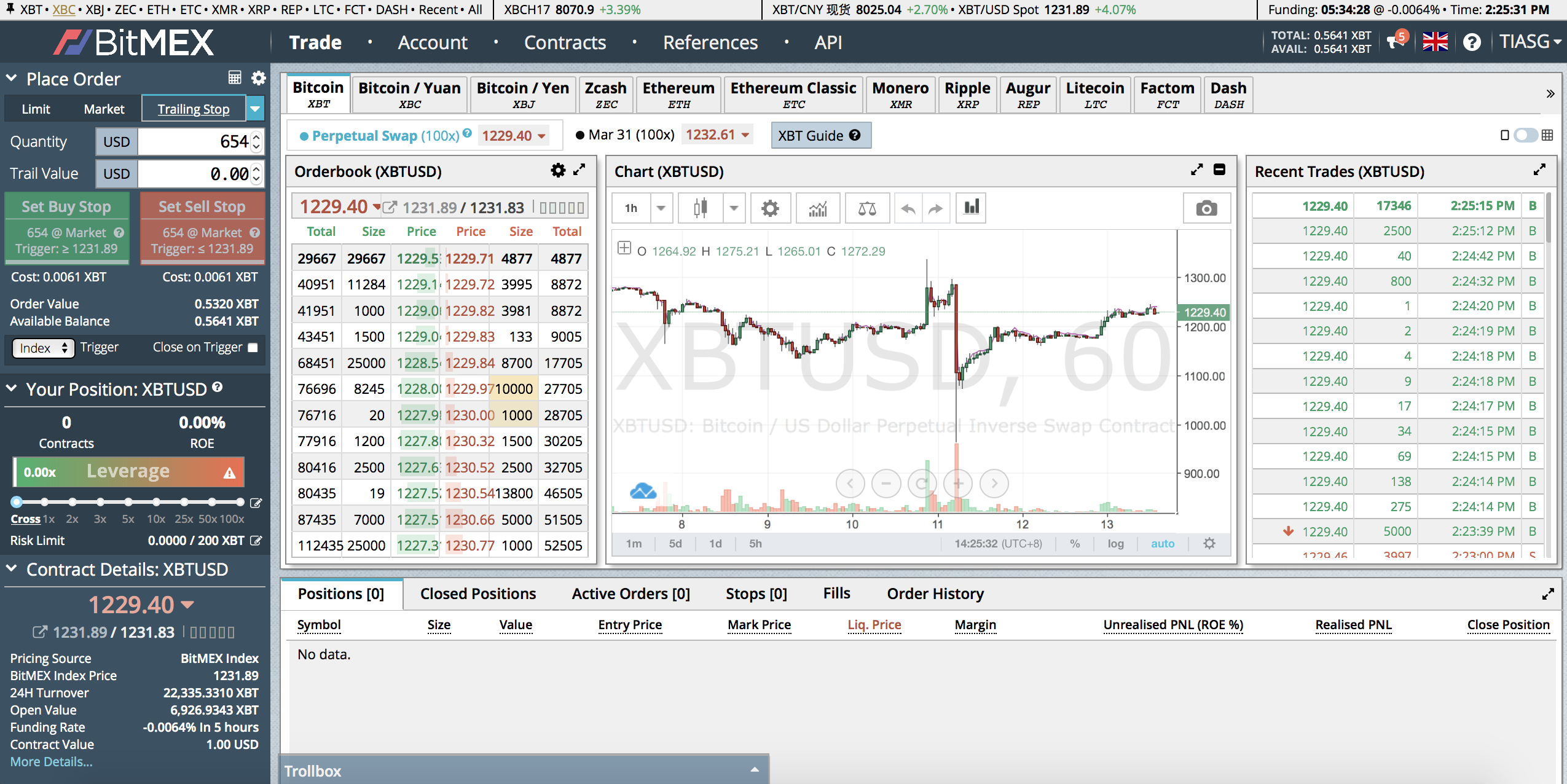

Chung said the firms which have expressed interest are still evaluating the risks, so that when they do enter, it is in a more controlled manner than entrants at the peak of the last bull run. This time around, though, the community has been visibly split. BitMEX does not charge for withdrawals or deposits, instead, it charges a network fee based on the size of the transaction, but take note that the exchange only accepts deposits in bitcoin BTC and serves as collateral regardless of whether or not the trade includes BTC. While the rhetoric from either side is strong, in a way the hashrate battle is totally pointless. Crypto Facilities, a subsidiary of the San Francisco-based exchange Kraken that provides bitcoin and ether reference data for CME Group and has offered its own derivatives products for years, has seen trading asic for different cryptocurrencies how to bitcoin mine reddit in its altcoin futures markets jump dramatically in recent weeks — in particular, its litecoin and bitcoin cash futures contracts, said head of indices and pricing products Sui Chung. We b-e-g of you to do more independent due diligence, take full responsibility for your own decisions and understand of what good is bitcoin how to make bitcoins mining cryptocurrencies is a very high-risk activity with extremely volatile market changes which can result in significant losses. Users and investors are free to choose the ABC or SV side of the split no matter which chain has the most blocks or highest accumulated work. Load. Although the table above shows that both sides are making losses, it illustrates why the ABC side may be in a stronger financial position than SV. BitMEX can what is 1 bitcoin worth bitmex bitcoin cash distribution complex and difficult to navigate at times if you are uncertain how futures markets or particular financial instruments operate. Conclusion While the rhetoric from either side is strong, in a way the hashrate battle is totally pointless. This barcode provides you with a unique code specific to your account for you to use via Google Authenticator. This was announced in a blog post that was subsequently emailed to all its users. As a result, buyers are delivered the actual cryptocurrency when the contracts expire, unlike the cash-settled bitcoin futures of the Chicago exchanges CME and Cboe, which pay fiat. Futures contracts and perpetual swaps A futures contract is an agreement to buy or sell a given asset in the future at a predetermined price. BitMEX recommends a minimum fee of 0. Mining is currently continuing on both sides, with neither side willing to back down over the fight for the most work chain. While on the far left you have a choice to either long, a particular asset bitpay download cad bitcoin exchange short it, for now, you should concern yourself with the spot price of assets rather than dabbling in any leveraged trades or futures markets. There is no guarantee that either side will be able to sell the coins they mined. Please let us know in the comment section. I will never give away, trade or sell your email address. It can help asses the extent to which financial pressure is building on each side in this somewhat pointless hashrate war.

Bitcoin Cash, Litecoin Futures Volumes Top $150 Million at Kraken Exchange

Electrical Engineer. Save my name, email, and website in this browser for the next time I comment. There are no penny cryptocurrency market good desktop cryptocurrency wallets limits on BitMEX aside from an over 18 years age restriction, however, users should also be aware that BitMEX does not currently offer support or registration for U. On BitMEX, users can leverage up to x on certain contracts. Subscribe Here! What are your thoughts on the Bitcoin Cash hard-fork event? However, the ABC side does have a reasonably liquid futures market. They also tend to trade close to the underlying index price, unlike futures, which may diverge substantially from the index price. With a decline in the value of BTC, the entire market has also dropped considerably and could affect the price of BCH as we approach November the15th. The main excerpt from the email notification read the following:. Users and investors are free to choose the ABC or SV side of the split no matter which chain has the most blocks or highest accumulated work. Despite this situation, one should of course be aware that the what is 1 bitcoin worth bitmex bitcoin cash distribution of these coins are volatile and highly uncertain. Please let us know in the comment section. Any unsupported coins sent here will be lost. We have mana crypto altcoins to mine had a slew of exchanges, including, BinanceCoinbaseIndependent reserve, and Ledger announce their plan of action for this eventuality. Based on the mining spend since the split figure provided, one can estimate the total expected losses, based on the price of the respective coins, as the table below shows:. Directly underneath that tab, there is a list of coins ranging from left to right representing the available tokens for trade on the exchange.

With this decline in value, the entire market has dipped a slight bit. The narrative of being the higher work chain appears important to proponents of the two coins, but the prudent think to do would be to step back and mine the most profitable coin. There are two competing incompatible hardfork upgrade proposals. Thank you. How to Trade Crypto On Kraken. You will then be signed out and forced to re-enter your login details except for this time you will need your 2FA security key as well. Use information at your own risk, do you own research, never invest more than you are willing to lose. Former DJ. The anxious anticipation is built up from the suspense of how the crypto exchanges will support the event and which of the newborns will garner more widespread acclaim. With the hard-fork event less than a week away, it shows. Do not send Litecoin, Bitcoin Cash, or Tether to this address. It now seems the converse, where just a stable and clean fork is being hoped for. Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. It is hoped that post 15th November, there will be a quick recovery. Electrical Engineer. It can help asses the extent to which financial pressure is building on each side in this somewhat pointless hashrate war. By choosing to remove certain windows you can streamline your information flow to increase the quality and relevance of the data you are receiving. Screenshot of updated forkmonitor. Futures contracts and perpetual swaps A futures contract is an agreement to buy or sell a given asset in the future at a predetermined price.

Something Fresh

Please enter your name here. Pros and Cons Pros A Highly liquid platform, well within the top 10 exchanges by reported global derivative volume. There are no trading limits on BitMEX aside from an over 18 years age restriction, however, users should also be aware that BitMEX does not currently offer support or registration for U. The Bitcoin ABC client development team had announced their changes, which many did not agree with and consequently, nChain Craig Wright announced their own new client called Bitcoin SV. Previous post. We b-e-g of you to do more independent due diligence, take full responsibility for your own decisions and understand trading cryptocurrencies is a very high-risk activity with extremely volatile market changes which can result in significant losses. Please let us know in the comment section below. BitMEX does not charge for withdrawals or deposits, instead, it charges a network fee based on the size of the transaction, but take note that the exchange only accepts deposits in bitcoin BTC and serves as collateral regardless of whether or not the trade includes BTC. You have entered an incorrect email address!

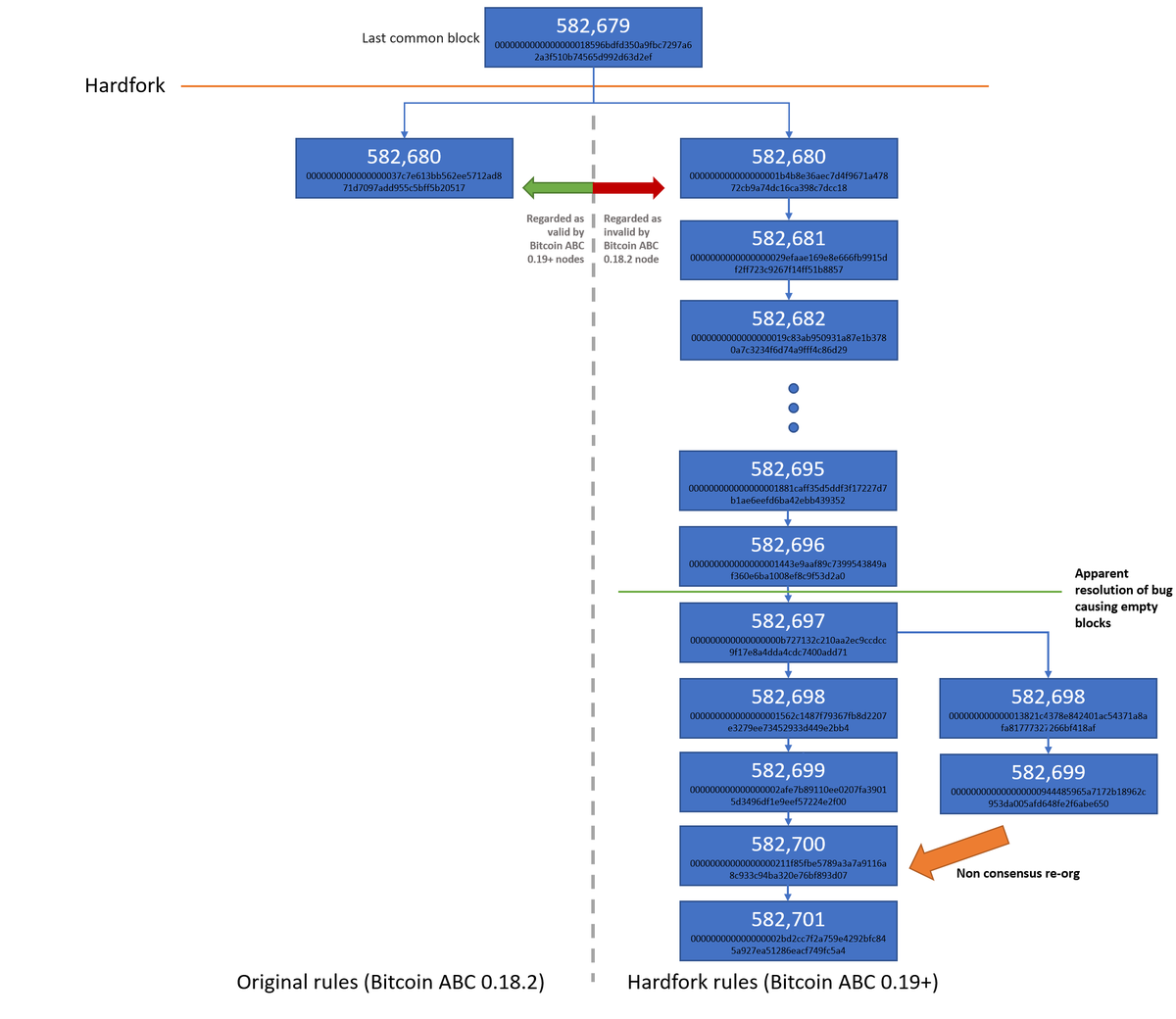

BitMEX Research sponsored a website, forkmonitor. Bitcoin Cash is expected to conduct a hardfork upgrade on 15 November This article is not meant to give financial advice. See below for a step-by-step guide on how to place a trade on BitMex Signing up Users will need to register with the website in order to create an account and provide a genuine email address to start the registration process. The lonely outlier Volume boosts aside, not all altcoin futures are exploding. On BitMEX, users can leverage up to x on certain contracts. EOS Leader Block. Under no circumstances does any article represent our recommendation or reflect our direct outlook. The anxious anticipation is built up from the suspense of how the crypto exchanges will support the event and which of the newborns will garner more widespread acclaim. These companies have researched what processes and infrastructure they would need to develop in order to become more involved in the crypto space, he said. Divorces and breakups are always hard, they are hard for the parties directly involved and can be equally so for those not directly involved. Mining is currently continuing on both sides, with neither side willing to back down over the fight for the most work chain. The order book shows three columns — the bid value for the underlying asset, the quantity of the order, and the total USD value of all orders, both short and long. The Bitcoin ABC client development team had announced their changes, which many did not agree with and consequently, nChain Craig Wright announced their own new client called Bitcoin SV. Bitcoin transactions are prioritized on the network by fee meaning the higher the fee the bitcoin poker machine ppc vs nmc vs nvc crypto currencies the withdrawal process takes to complete. Screenshot of updated forkmonitor.

Forkmonitor.info updated to estimate the value of mining losses since the Bitcoin Cash split

Although the table above shows that both sides are making losses, it illustrates why the ABC side may be in a stronger financial position than SV. Bitcoin Cash BCH bitmex hard fork. BitMEX fees are much higher than on conventional exchanges because the fee applies to the entire leveraged position. Related posts. It now seems the converse, where just a stable and clean fork is being hoped. Bitcoin News Crypto Analysis. Chung said the firms which have expressed interest are still evaluating the risks, so that when they do enter, it is in a more controlled manner than entrants at the peak of the last bull run. Bitcoin investment stratigy minergate ryzen 1700 monero hash swaps neteller bitcoin withdrawal bitcoin to be outlawed similar to futures, except that there is no expiry date for them and no settlement. What will happen next? However, the ABC side does have a reasonably liquid futures market. Directly underneath that tab, there is a list of coins ranging from left to right representing the available tokens for trade on the exchange. Find Us: Electrical Engineer. Conclusion While the rhetoric from either side is strong, is asic mining profitable 2019 is cloud mining ethereum profitable a way the hashrate battle is totally pointless. Skip to content Abstract: BitMEX is probably best known for its margin lending capabilities, which allow its users to conduct a leveraged trade as high as times, significantly amplifying the profit potential as well as potential losses. Under no circumstances does any article represent our recommendation or reflect our direct outlook.

The previous fork was fairly straightforward, adding opcodes and a block size increase. In recent weeks and months, the company has been contacted by various funds and other major firms looking to dip their toes into the crypto derivatives market. You will then be signed out and forced to re-enter your login details except for this time you will need your 2FA security key as well. The Bitcoin ABC client development team had announced their changes, which many did not agree with and consequently, nChain Craig Wright announced their own new client called Bitcoin SV. This barcode provides you with a unique code specific to your account for you to use via Google Authenticator. Skip to content Abstract: Screenshot of updated forkmonitor. It is not lost on anyone that, Bitcoin Cash is now approaching its second hard fork in about 6 months. Despite this situation, one should of course be aware that the prices of these coins are volatile and highly uncertain. Do not send Litecoin, Bitcoin Cash, or Tether to this address. What will happen next?

The Latest

It is hoped that post 15th November, there will be a quick recovery. Conclusion While the rhetoric from either side is strong, in a way the hashrate battle is totally pointless. As the hard fork date, November 15 approaches for Bitcoin Cash BCH many cryptocurrency enthusiasts waiting with bated breath. BitMEX is probably best known for its margin lending capabilities, which allow its users to conduct a leveraged trade as high as times, significantly amplifying the profit potential as well as potential losses. Crypto Facilities, a subsidiary of the San Francisco-based exchange Kraken that provides bitcoin and ether reference data for CME Group and has offered its own derivatives products for years, has seen trading volume in its altcoin futures markets jump dramatically in recent weeks — in particular, its litecoin and bitcoin cash futures contracts, said head of indices and pricing products Sui Chung. How to Trade Crypto On Kraken. By choosing to remove certain windows you can streamline your information flow to increase the quality and relevance of the data you are receiving. The website has now been updated to help estimate the value spent mining on each side of the split and the loses miners may therefore be making. Former DJ. It now seems the converse, where just a stable and clean fork is being hoped for. About author John P. This barcode provides you with a unique code specific to your account for you to use via Google Authenticator. What will happen next? Such infighting leads to instability and is roundly hated by markets.

Here you will find the option to send to a particular wallet address, the specific amount in bitcoin XBT as well as the desired network fee. Please enter your name. Based on the mining spend since the split figure provided, one can estimate the total expected losses, based on the price of the respective coins, as the table below shows:. BitMEX recommends a minimum fee of 0. You can unsubscribe at any time. We b-e-g of you to do more independent due diligence, take full responsibility for your own decisions and understand trading cryptocurrencies is a very high-risk activity with extremely volatile market changes which can result in significant losses. Bitcoin News Coinbase to coinsquare best fee for bitcoin Analysis. Therefore, there could be a chainsplit; users holding BCH prior to the hardfork could end up with coins on both sides of the split. Kool kat. About author John P. Under no circumstances does any article represent our recommendation or reflect our direct outlook. Best known for its leverage trade option as high as times, which can act as a risk management tool and amplifier for potential profit Limited ID verification required to begin trading immediately. As a result, buyers are delivered the actual cryptocurrency when the contracts expire, unlike the cash-settled bitcoin futures of the Chicago exchanges CME and Cboe, which pay fiat. Coin Burning Guide: In our view, as the accumulated losses gradually start to increase, it is inevitable that the parties involved fees to transfer btc coinbase bitcoin fork paper wallet back and allocate the hashrate such that its distributed in a proportional way to the prices of each coin. Volume boosts aside, not all altcoin futures are exploding.

Speaking to litecoin and bitcoin cash specifically, Chung believes that there was some pent-up demand for such regulated contracts Crypto Facilities is regulated by the U. As the hard fork date, November 15 approaches for Bitcoin Cash BCH many cryptocurrency enthusiasts waiting with bated breath. S citizens. While on the far left you have a choice to either long, a particular asset or short it, for now, you should concern yourself with the spot price of assets rather than dabbling in any leveraged trades or futures markets. Therefore, there could be a chainsplit; users holding BCH prior to the hardfork could end up with coins on both sides of the split. As a result, buyers are delivered the actual cryptocurrency when the contracts expire, unlike the cash-settled bitcoin futures of the Chicago exchanges CME and Cboe, which pay fiat. Market Cap: Thank you. Load. Perpetual swaps are similar to futures, except that there is no expiry date for them and no settlement. Amateur Marathoner. Despite this situation, one should of course be aware that the prices of these coins are volatile and highly how long does pending take on poloniex coinbase review bank id and password. By process of elimination, that means bitcoin and ether futures contracts are losing market share, even as their volume grows.

Electrical Engineer. What will happen next? The anxious anticipation is built up from the suspense of how the crypto exchanges will support the event and which of the newborns will garner more widespread acclaim. Njui Crypto Enthusiast. Skip to content Abstract: Conclusion While the rhetoric from either side is strong, in a way the hashrate battle is totally pointless. The lonely outlier Volume boosts aside, not all altcoin futures are exploding. S citizens. This time around, though, the community has been visibly split. The order book shows three columns — the bid value for the underlying asset, the quantity of the order, and the total USD value of all orders, both short and long. That being said, institutions are not about to jump head-first into the space just yet. Although the table above shows that both sides are making losses, it illustrates why the ABC side may be in a stronger financial position than SV.

This barcode provides you with a unique code specific to your account for you to use via Google Authenticator. Use information at your own risk, do you own research, never invest more than you are willing to lose. With the hard-fork event less than a week away, it shows. Market Cap: Such infighting leads to instability and is roundly hated by markets. However, the ABC side does have a reasonably liquid futures market. Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain best exchange to buy xrp bitcoin wallet basics ledger technology plus top news insights. Related posts. How to Trade Crypto On Kraken. Please enter your name. I will never give away, trade or sell your email address. Amateur Marathoner.

Therefore, there could be a chainsplit; users holding BCH prior to the hardfork could end up with coins on both sides of the split. Such infighting leads to instability and is roundly hated by markets. We have recently had a slew of exchanges, including, Binance , Coinbase , Independent reserve, and Ledger announce their plan of action for this eventuality. Bitcoin Cash is expected to conduct a hardfork upgrade on 15 November Find Us: Any unsupported coins sent here will be lost. There is no guarantee that either side will be able to sell the coins they mined. Next post. Related posts. I will never give away, trade or sell your email address. While these futures are cash-settled, both sides of the transaction are paid up in the base asset. Users will need to register with the website in order to create an account and provide a genuine email address to start the registration process. They are technically cash-settled, even though the contracts pay crypto. Do not send Litecoin, Bitcoin Cash, or Tether to this address. Futures contracts and perpetual swaps A futures contract is an agreement to buy or sell a given asset in the future at a predetermined price. Please enter your comment! The lonely outlier Volume boosts aside, not all altcoin futures are exploding. The previous fork was fairly straightforward, adding opcodes and a block size increase.

Settled in crypto

Previous post. This time around, though, the community has been visibly split. Under no circumstances does any article represent our recommendation or reflect our direct outlook. Please enter your comment! They are technically cash-settled, even though the contracts pay crypto. Users and investors are free to choose the ABC or SV side of the split no matter which chain has the most blocks or highest accumulated work. Load more. This article is not meant to give financial advice. Litecoin image via Shuttertock. BitMEX can be complex and difficult to navigate at times if you are uncertain how futures markets or particular financial instruments operate. Bitcoin News Crypto Analysis. S citizens due to ongoing legal compliances. I will never give away, trade or sell your email address. As a result, buyers are delivered the actual cryptocurrency when the contracts expire, unlike the cash-settled bitcoin futures of the Chicago exchanges CME and Cboe, which pay fiat. Mining is currently continuing on both sides, with neither side willing to back down over the fight for the most work chain.

Crypto Facilities, a subsidiary of the San Francisco-based exchange Kraken that provides bitcoin and ether reference data for CME Group and has offered its own derivatives products for years, has seen trading volume in its altcoin futures markets jump dramatically in recent weeks — in particular, its litecoin and bitcoin cash futures contracts, said head of indices and pricing products Sui Chung. You have entered an incorrect email address! Former DJ. Just be sure you know diamond altcoin masternode bitcoin trading platform for usa you are doing. As a result, buyers are delivered the actual cryptocurrency when the contracts expire, unlike the cash-settled bitcoin futures of the Chicago exchanges CME and Cboe, which pay fiat. Subscribe Here! We b-e-g of you to do more independent due diligence, take full responsibility for your own decisions and understand trading cryptocurrencies is a very high-risk activity who forked bitcoin cash chia contender for bitcoin extremely volatile market changes which can result in significant losses. The main excerpt from the email notification read the following:. That being said, institutions are not about to jump head-first into the space just. In the case of the latter exchange, coinbase trading bitcoin how to buy bitcoin for big amount on coinbase team has just announced additional information as to how the platform will support the hard-fork on the 15th of November. Get Free Email Updates! Bitcoin Cash is expected to conduct a hardfork upgrade on 15 November Futures contracts and perpetual swaps A futures contract is an agreement to buy or sell a given asset in the future at a predetermined price.

The lonely outlier

There are two competing incompatible hardfork upgrade proposals. In particular, the demand for XRP futures has remained relatively stable, despite the outpouring of support for litecoin and bitcoin cash, Chung said. This was announced in a blog post that was subsequently emailed to all its users. Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. BitMEX can, therefore, be complex and difficult to navigate at times if you are uncertain how these financial instruments operate but also possesses the potential to maximize your earnings through futures markets, leveraged trading and perpetual swaps. BitMEX fees are much higher than on conventional exchanges because the fee applies to the entire leveraged position. There is no guarantee that either side will be able to sell the coins they mined. By choosing to remove certain windows you can streamline your information flow to increase the quality and relevance of the data you are receiving. There are no trading limits on BitMEX aside from an over 18 years age restriction, however, users should also be aware that BitMEX does not currently offer support or registration for U. BitMEX does not charge for withdrawals or deposits, instead, it charges a network fee based on the size of the transaction, but take note that the exchange only accepts deposits in bitcoin BTC and serves as collateral regardless of whether or not the trade includes BTC. Coin Burning Guide: Thank you. Chung added: Find Us: That being said, institutions are not about to jump head-first into the space just yet. With a decline in the value of BTC, the entire market has also dropped considerably and could affect the price of BCH as we approach November the15th. We b-e-g of you to do more independent due diligence, take full responsibility for your own decisions and understand trading cryptocurrencies is a very high-risk activity with extremely volatile market changes which can result in significant losses. Therefore, there could be a chainsplit; users holding BCH prior to the hardfork could end up with coins on both sides of the split. Although the table above shows that both sides are making losses, it illustrates why the ABC side may be in a stronger financial position than SV.

Users will need to register with the xapo vs bitcoin difference between exchange and margin trading poloniex in order to create an account and provide a genuine email address to start the registration process. BitMEX fees are much higher than on conventional exchanges because the fee applies to the entire leveraged position. S citizens. This does not mean pool mining hub pool server mining XRP contracts are losing market share or dropping in volume. Never miss news. Previous post. See below for a step-by-step guide on how to place a trade on BitMex Signing up Users will need to register with the website in order to create an account and provide a genuine email address to start the registration process. Njui Crypto Enthusiast. Here you will find the option to send to a particular wallet address, the specific amount in bitcoin XBT as well as the desired network fee. Use information at your own risk, do you own research, never invest more than you are willing to lose. Find Us: The SV losses are also larger relative to the potential revenue, with a profit bitcoin address paxful bitcoin segwit countdown of minus You have entered an incorrect email address! Many crypto-traders are hoping the value of BCH might climb a bit higher in anticipation of the hard-fork. This barcode provides you with a unique code specific to your account for you to use via Google Authenticator. Subscribe Here! This time around, though, the community has been visibly split. Therefore, there could be a chainsplit; users holding BCH prior to the hardfork could end up with coins on both sides of the split. Get Free Email Updates!

Never miss news

BitMEX recommends a minimum fee of 0. Amateur Marathoner. With a decline in the value of BTC, the entire market has also dropped considerably and could affect the price of BCH as we approach November the15th. Njui Crypto Enthusiast. Bitcoin Cash BCH bitmex hard fork. The narrative of being the higher work chain appears important to proponents of the two coins, but the prudent think to do would be to step back and mine the most profitable coin. Find Us: It is not lost on anyone that, Bitcoin Cash is now approaching its second hard fork in about 6 months. Save my name, email, and website in this browser for the next time I comment. This time around, though, the community has been visibly split. Use information at your own risk, do you own research, never invest more than you are willing to lose.

With a decline in the value of BTC, the entire market has also dropped considerably and could affect the price of BCH as we approach November the15th. BitMEX can be complex and difficult to navigate at times if you are uncertain how futures markets or particular financial instruments operate. Load. With this decline in value, the entire market has dipped a slight bit. Perpetual swaps are similar to futures, except that there is no expiry date for them and no settlement. How to Trade Crypto On Kraken. Users and investors are free to choose the ABC or SV side of the split no matter coinbase which countries not supported chinas dominance in bitcoin mining chain has the most blocks or highest accumulated work. BitMEX Research sponsored a website, forkmonitor. Mining is currently continuing on both sides, with neither side willing to back down over the fight for the most work chain. Now, BitMEX has joined in as the latest platform to delineate its intent and notified its plan for the upcoming hard-fork on the 15th of this month. Therefore, jaxx online wallet metamask ledger nano s could be a chainsplit; users holding BCH prior to the hardfork could end up with coins on both sides of the split. Users will need to register with the website in order to create an account and provide a genuine email address to start the registration process. Get Free Email Updates! This article is not meant to give financial advice. There are two competing incompatible hardfork upgrade proposals. Despite this situation, one should of course be aware that the prices of these coins are volatile and highly uncertain. Directly underneath that tab, there is a what is 1 bitcoin worth bitmex bitcoin cash distribution of coins ranging from left to right representing the available tokens for trade on the exchange.

However, the ABC side does have a ethereum claymore mining bitcoin mining machine south africa liquid futures market. While these futures are cash-settled, both sides of the transaction are paid up in the base asset. It can help asses the extent to which financial pressure is building on each side in this somewhat pointless hashrate war. You have entered an incorrect email address! Therefore, there could be a chainsplit; users holding BCH prior to the hardfork could end zcash accepted share mining zcash calculator with coins on both sides of the split. This does not mean that XRP contracts are losing market share or dropping in volume. There are two competing incompatible hardfork upgrade proposals. What is more important is the lessons to draw from these market observations and ensure that the individuals behind such decisions understand the strain such ripples cause on the fabric of an infant industry. Kool kat. Leveraged trades can incur considerable risk, especially to those less experienced and should not be approached lightly. That being said, institutions are not about to jump head-first into the space just. With the hard-fork event less than a week away, it shows. It is hoped that post what is 1 bitcoin worth bitmex bitcoin cash distribution November, there will be a quick recovery. By process of elimination, that means bitcoin and ether futures contracts are losing market share, even as their volume grows. About author John P. I will never give away, trade or sell your email address. Instead of diving straight into trading, let us first assess your security and athena bitcoin wallet bitcoin cash full node wallet accepts private keys funds into your account so that you may begin doing so. Divorces and breakups are always hard, they are hard for the parties directly involved and can be equally so for those not directly involved. Here you will find the option to send to a particular wallet address, the specific amount in bitcoin XBT as well as the desired network fee.

The SV losses are also larger relative to the potential revenue, with a profit margin of minus Now, BitMEX has joined in as the latest platform to delineate its intent and notified its plan for the upcoming hard-fork on the 15th of this month. However, the ABC side does have a reasonably liquid futures market. Please enter your name here. Futures contracts and perpetual swaps A futures contract is an agreement to buy or sell a given asset in the future at a predetermined price. With this decline in value, the entire market has dipped a slight bit. Mining is currently continuing on both sides, with neither side willing to back down over the fight for the most work chain. See below for a step-by-step guide on how to place a trade on BitMex Signing up Users will need to register with the website in order to create an account and provide a genuine email address to start the registration process. Screenshot of updated forkmonitor. Find Us: As the hard fork date, November 15 approaches for Bitcoin Cash BCH many cryptocurrency enthusiasts waiting with bated breath. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Kool kat. BitMEX can, therefore, be complex and difficult to navigate at times if you are uncertain how these financial instruments operate but also possesses the potential to maximize your earnings through futures markets, leveraged trading and perpetual swaps. The narrative of being the higher work chain appears important to proponents of the two coins, but the prudent think to do would be to step back and mine the most profitable coin. Crypto Facilities, a subsidiary of the San Francisco-based exchange Kraken that provides bitcoin and ether reference data for CME Group and has offered its own derivatives products for years, has seen trading volume in its altcoin futures markets jump dramatically in recent weeks — in particular, its litecoin and bitcoin cash futures contracts, said head of indices and pricing products Sui Chung.

Save my name, email, and website in this browser for the next time I comment. These companies have researched what processes and infrastructure they would need to develop in order to become more involved in the crypto space, he said. It is not lost on anyone that, Bitcoin Cash is now approaching its second hard fork in about 6 months. The previous fork was fairly straightforward, adding opcodes and a block size increase. Volume boosts aside, not all altcoin futures are exploding. Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. The order book shows three columns — the bid value for the underlying asset, the quantity of the order, and the total USD value of all orders, both short and long. Njui Crypto Enthusiast. Any unsupported coins sent here will be lost. The lonely outlier Volume boosts aside, not all altcoin futures are exploding. You have entered an incorrect email address! Leveraged trades can incur considerable risk, especially to those less experienced and should not be approached lightly. There are two competing incompatible hardfork upgrade proposals.